![]() Although they have no independent ability to conduct clinical studies or manufacture their own products, IntelGenx Technologies Corp. (IGXT) is a “buy“. Wall Street analysts at Aegis initiated coverage on the drug delivery company and gave IGXT stock a $2.50 price target, nearly 5 times the current price of the penny stock, 0.531. An bold move by the experts for a Company that is just as aggressively focused on making approved drugs better.

Although they have no independent ability to conduct clinical studies or manufacture their own products, IntelGenx Technologies Corp. (IGXT) is a “buy“. Wall Street analysts at Aegis initiated coverage on the drug delivery company and gave IGXT stock a $2.50 price target, nearly 5 times the current price of the penny stock, 0.531. An bold move by the experts for a Company that is just as aggressively focused on making approved drugs better.

![]() Looking for Hot Penny Stocks? Click here and get Alerts on the Best Penny Stocks FREE.

Looking for Hot Penny Stocks? Click here and get Alerts on the Best Penny Stocks FREE.

IGXT Stock Chart / Structure

IGXT Stock Chart / Structure

Market Cap (intraday): 26.35M

Price/Sales (ttm): 40.82

Price/Book (mrq): 6.89

Operating Cash Flow (ttm): -1.18M

52-Week High

(Aug 2, 2011): 0.85

52-Week Low

(Dec 9, 2011): 0.40

Avg Vol (3 month): 57,271

Avg Vol (10 day): 37,429

Shares Outstanding: 49.62M

Float: 49.57M

Ytd Percent Change: -5.17%

Ytd Moving Average: 0.5279

Ytd Average Volume: 124,699

Roughly a month after following the path Yippy Inc. (YIPI) by uplisting to the OTCQX, IntelGenx attracted enough attention after their completion of the pivotal bioequivalence study for a novel oral thin-film formulation of Rizatriptan, the active drug in Maxalt-MLT® orally disintegrating tablets.

Stepping up to the plate to compete with Merck & Co. (MRK), the manufatures of Maxalt-MLT®, a leading branded anti-migraine product, IntelGenx wants to get a peice of the $639 million in sales Merck got from sales of Maxalt® in 2011. However, this is simply one of a number of drugs that the Company is actively developing which could all be on the market within the next 3-5 years.

Considering that revenues have grown by nearly 200% to $285 million for the three months ended March 31, 2012 compared to the same period in 2011, IntelGenx has a firm grasp on the growth factor with Net Loss decreasing to $582 million for the three months ended March 31, 2012 compared to $600 million for the same period in 2011.

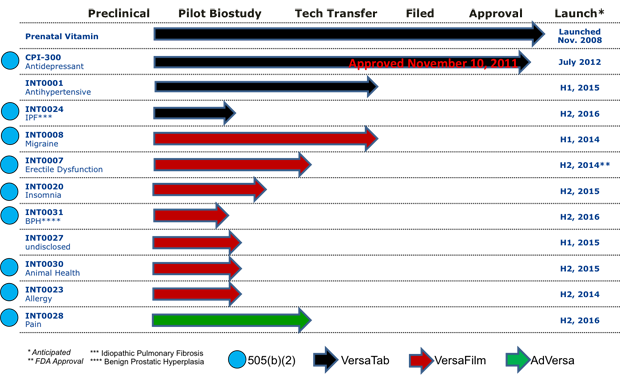

IGXT Drug Pipeline

About IGXT Stock

IntelGenx Technologies Corp. is a drug delivery company focused on the development of oral controlled-release products as well as novel rapidly disintegrating delivery systems. The Company uses its unique multiple layer delivery system to provide zero-order release of active drugs in the gastrointestinal tract. In addition to, the Company has also developed novel delivery technologies for the rapid delivery of pharmaceutically active substances in the oral cavity based on its experience with rapidly disintegrating films. At present, the research and development pipeline includes products for the treatment of :

- severe depression,

- hypertension,

- erectile dysfunction,

- benign prostatic hyperplasia,

- migraine,

- insomnia,

- bipolar disorder,

- idiopathic pulmonary fibrosis,

- allergies, and

- pain management

Bottom Line: If you are willing to long on penny stocks and have the patience for drug developers like IntelGenx Technologies Corp., IGXT, you could win big. With a year-to-date low of just 0.445, IGXT stock cant get much cheaper than it already is.

Here is your opportunity to subscribe to the Most Exclusive Penny Stock newsletter.

Sign up with your email address now & get ready to make BIG PROFITS on Hot Penny Stocks

(We are 100% Anti-Spam and will never rent or sell your information)

ShareJUL