![]()

When you think about good energy stocks, Exxon Mobil Corp. (NYSE:XOM) is commonly considered one of the best companies in the stock market today. Exxon Mobil is the third generation of Standard Oil Company and has become an exceptionally efficient company. Exxon Mobile has consistently provided mammoth returns to its faithful shareholders.

In 2011, XOM earned more than $40B on $470B revenue. That figure tallies to a 9% profit margin. XOM is trading as of today at a P/E ratio of 10.25. Outstanding results at a bargain price.

But there is another energy company that has had even better results than Exxon Mobil and is trading as of today at a P/E ratio of just 3.25.

Gazprom (Pink Sheets: OGZPY.PK)

First, look how the numbers totaled for the year 2010:

| —> | EXXON MOBIL | GAZPROM |

| REVENUE | $383B | $120B |

| NET PROFIT | $31B | $32B |

| NET MARGIN | 8% | 26% |

| RETURN ON ASSETS | 13.5% | 14% |

| PRICE / CASH FLOW | 7 | 2.76 |

| DEBT / CAPITAL | 9% | 15% |

(Source: Financial Times)

Now, consider the numbers for the first half of 2011:

| —> | EXXON MOBIL | GAZPROM |

| REVENUE | $230B | $75B |

| NET PROFIT | $21B | $25B |

| NET MARGIN | 9% | 33% |

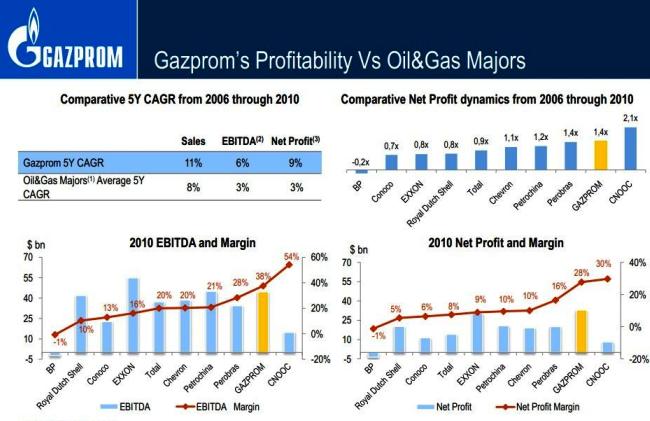

Now, the chart below shows how Pink Sheets trading Gazprom, OGZPY, compares to other integrated Oil and Gas majors on the NYSE, including emerging markets players PetroBras (NYSE: PBR) and Petrochina (NYSE: PTR):

(Source: Gazprom IFRS 2011 Financial Results)

The results are impressive to say the least and should mandate a higher stock price. Even though OGZPY is slightly over 50% owned by the Russian Government, the shares are cheap for some reason. Yes the Kremlin appoints more than 50%, six out of eleven, members of the board and their political plans do not list minority shareholders’ interests at the top of their list. Yet domestic guidelines oblige Gazprom to sell its gas in Russia at more than 67% less than the export price.

Gazprom may be authorized to raise prices by 15% this year which would result in millions of dollars of profits while billions get converted into greenhouse gasses due to the Kremlin’s price control on domestic gas.

Another point to consider which is pulling down the stock price is that the global gas reserves were revised up after the recent shale gas boom. Some reports claim that Europe’s gas reserves could increase by 50% if Poland’s shale reserves are confirmed. If that is true, the EU countries will be extremely less dependent on Russian gas and Moscow will be forced to lower prices in order to be competitive.

Gazprom is likely to be forced to stream billions of dollars in new projects to expand its weakening production rates and renew its aging infrastructure. An infrastructure of over 100,000 miles of pipelines which are 30 to 40 years old.

Adding uncertainty to Gazprom’s cheap stock price is that fact that investors are demanding more transparency of subsidiaries engaged in motley activities like Gazprom Avia, Gazprom Bank and Gazprom Media.

Chart Analysis:

Even though the company’s increasing competition from other gas sources in the strategic Chinese markets, consider Gazprom a great value play at these prices.

About AimHighProfits.com

AimHighProfits.com strives to provide you with the hottest stock alerts in the market in Real-Time. We focus on stocks that trade for $5 per share or less, some as little as a few pennies with upside potential. Our goal is committed to producing and publishing the highest-quality insight and analysis of small-cap stocks, emerging technology stocks, hot penny stocks and helping investors make informed decisions and to inform you of the best stocks in the market before they move. Our focus is primarily on OTC stocks in the stock market today which have traditionally been ignored by Wall Street.

We have particular expertise with internet stocks, gold stocks, renewable energy stocks, biotech stocks, oil stocks and green energy stocks. There are many hot penny stock opportunities present in the OTC market every day and we seek to exploit these hot stock gains for our members before the average daytrader is made aware of them.

Aim High Profits Disclaimer

This newsletter is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. AimHighProfits.com is a wholly-owned subsidiary of Kelevra Media Innovation.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a real licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

ShareJAN